Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Explore an Amortization Chart Islamic financing guide, covering key mortgage options, profit rates, and Shariah-compliant payment structures

Islamic financing offers an ethical alternative to conventional finance by avoiding interest-based transactions and focusing on risk-sharing and asset-backed investments. This comprehensive guide explores how amortization chart Islamic mortgages, offering insights into the repayment structures that align with Shariah law.

Islamic finance operates under the principles of Shariah, an ethical framework that mandates financial transactions to be free from exploitative practices. The core tenets of Islamic finance are designed to promote fairness, equity, and justice in economic dealings. A fundamental difference between Islamic and conventional finance is the prohibition of riba (interest). While conventional finance systems rely heavily on interest to generate profits, Islamic finance focuses on risk-sharing and tangible, asset-backed transactions. These guiding principles form the foundation of Islamic mortgage structures.

Islamic finance promotes justice and transparency in financial dealings, ensuring that both parties in a transaction benefit equitably. Shariah-compliant mortgages are structured to provide financial solutions that align with Islamic ethics, ensuring that both lenders and borrowers share risks and rewards.

To fully understand how amortization works in Islamic financing, it’s crucial to grasp the fundamental principles that guide these transactions. Some of the key principles include:

In Islamic finance, interest is seen as exploitative, as it guarantees profit for the lender regardless of the economic outcome for the borrower. Islamic mortgages eliminate interest charges, replacing them with profit-based models. This encourages transparent agreements between borrowers and lenders, as the profit is tied directly to the asset’s performance.

For example, in a Musharaka mortgage, the lender and borrower co-own the property, and the profit rate is reflective of the lender’s share in the property’s ownership. As the borrower buys out the lender’s stake, the profit portion of the payment declines, ensuring the transaction remains fair and aligned with the principles of Shariah.

In traditional finance, amortization refers to the process of repaying debt over time through regular installments that cover both the principal amount and interest. In Islamic finance, the concept of amortization is similar, except that instead of paying interest, borrowers make payments that cover the agreed-upon profit rate, along with the principal reduction.

Islamic mortgage amortization is structured to ensure that both parties benefit equitably. The payments made by the borrower are split into two components: the reduction in principal (the original amount borrowed) and the profit paid to the financier. The amount allocated to profit varies depending on the type of Islamic mortgage product used.

Amortization schedules are crucial in Islamic mortgages because they ensure transparency and fairness in the repayment process. These schedules break down how each monthly payment contributes to reducing the principal balance of the mortgage and how much is allocated to the financier’s profit. This clarity helps build trust and ensures that both parties are fully aware of their obligations.

For example, in a Murabaha mortgage, the agreed-upon profit margin is included in the fixed installment, which the borrower repays over time. The payments remain consistent, and the breakdown between principal and profit is clear, making the process transparent.

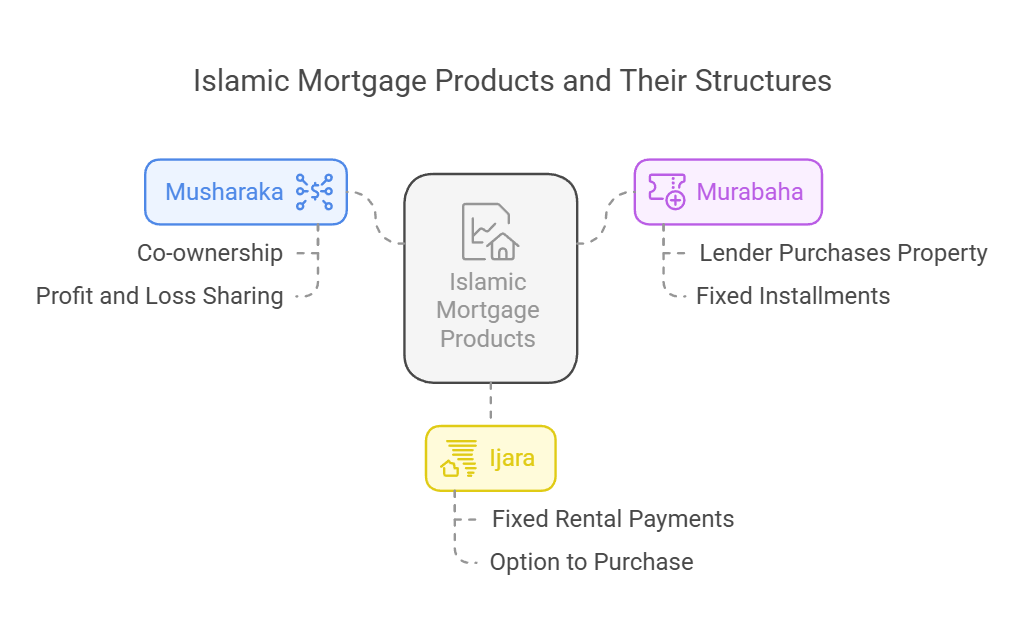

Islamic financing offers a variety of mortgage products, each tailored to different needs and preferences. These products are designed to adhere to the core principles of Shariah while providing flexibility for borrowers. Below are some of the most common types of Islamic mortgage products:

The Musharaka model is a partnership-based financing structure. In this arrangement, the borrower and the lender co-own the property, and the borrower gradually buys the lender’s share over time. As the borrower’s share of the property increases, the profit rate decreases. This structure aligns with the principles of profit and loss sharing, as both parties share in the risks and rewards associated with the property.

For example, in a 25-year Musharaka mortgage of $300,000, the borrower may make monthly payments of $1,582. Over time, the borrower’s share in the property increases, and the monthly payment allocated to profit decreases. By the end of the mortgage term, the borrower owns the property outright, and the profit portion of the payment will be minimal.

The Murabaha model is a cost-plus financing arrangement, where the lender purchases the property on behalf of the borrower and sells it to the borrower at a predetermined markup. The borrower then repays the amount in fixed installments. The key characteristic of Murabaha is that the profit margin is pre-agreed, and no interest is charged.

This model is often used for purchasing homes, and the payments are structured to be equal over the mortgage term. The Murabaha model is transparent and simple, as the borrower knows upfront the exact price of the property and the total cost of the mortgage.

The Ijara model is a leasing arrangement where the lender purchases the property and leases it to the borrower. The borrower makes fixed rental payments, and at the end of the lease term, the borrower may have the option to purchase the property. This model is beneficial for those who want to rent with the option to own the property in the future.

The Ijara model avoids the speculative risks often associated with conventional loans, as the payments remain fixed throughout the lease period. This provides stability for the borrower while ensuring that the lender earns a fair return on their investment.

Mortgage calculators are invaluable tools for borrowers seeking to understand how much they will need to repay each month under various Islamic mortgage products. These tools allow borrowers to estimate monthly payments, visualize amortization schedules, and understand the distribution between principal and profit. Most importantly, Islamic mortgage calculators are designed to comply with Shariah principles by excluding any interest-based calculations.

Several financial institutions offer Islamic mortgage calculators tailored to specific products. Some of the recommended calculators include:

Understanding the breakdown of each payment is essential for borrowers to track the progress of their mortgage. For example, in a Musharaka mortgage, each monthly payment is divided into two parts: one part reduces the outstanding principal, and the other part compensates the financier for their share of the investment. This clear division helps ensure transparency and allows borrowers to see how their payments are being allocated.

A Musharaka mortgage of $300,000 with a fixed profit rate may require a monthly payment of $1,582. As the borrower buys out the lender’s share over the 25-year period, the amount allocated to profit decreases, and the borrower gradually gains full ownership of the property. By the end of the term, the profit portion of the payment will drop to a minimal amount.

In a Murabaha mortgage of $220,000 (including a markup), the borrower will make 120 monthly payments of $1,833. These payments are fixed, and there is no interest charged. The agreed-upon profit margin remains constant, providing borrowers with a predictable repayment structure.

Islamic financing offers a transparent and equitable alternative to conventional mortgages. By eliminating interest and focusing on profit-sharing, asset-backed transactions, and fairness, Islamic mortgages provide ethical solutions for borrowers. Understanding amortization charts and the different types of Islamic mortgage products is essential for making informed decisions. With tools like Islamic mortgage calculators and expert guidance, borrowers can navigate the challenges of Islamic financing and secure a fair and Shariah-compliant mortgage solution.